What makes a profit institution different from a non-profit university? Options for parents with bad credit for student loans in 2022 | ACFA Cashflow

Parental loan options for students with bad credit Parents with low credit are still able…

Parental loan options for students with bad credit Parents with low credit are still able…

By Billy Begas President Ferdinand Marcos Jr.’s speech in his State of the Nation Address…

New / National / PH flags will fly at half mast in DepEd offices, schools…

WACO, Texas — As the need for skilled workers increases nationwide, enrollment in trades programs…

Comment this storyCommentEnrollment in DC’s traditional public and charter schools is expected to fall over…

Welcome to Thomas Insights – every day we post the latest news and analysis to…

HBCU, Mississippi Valley State University (MVSU) is offering those incarcerated at two delta prisons the…

Starting this summer, Baltimore County Public School (BCPS) high school students can take unlimited classes…

HOUSTON – A letter from Fair and equitable prosecution was signed by 80 district attorney’s…

Beginning in the fall of 2022, high school students in District 502 will have the…

AUSTIN (KXAN) — Following a Supreme Court decision to overturn Roe v. Wade, ending the…

Hi, Southampton! I’m here in your inbox today to tell you everything you need to…

Next Monday, June 20, will be the second Juneteenth officially recognized as a federal holiday…

By Maeve Lawler, Associate Editor of Enterprise News June 17, 2022The Office of Communications, Office…

Dr. Radha Plumb, Under Secretary of Defense, Chief of Staff, poses for her official portrait…

Social media platforms such as Twitter, Facebook and Tiktok will be required to register and…

Strained by the pandemic, nurses are leaving the profession at an unusually high rate. This…

(WHNT) – All state offices in Alabama will be closed next Monday in honor of…

Parallel implementations of the REAL ID system in New Jersey and at the federal level…

In partnership with University of Gloucestershire | glos.ac.uk The University of Gloucestershire has a long-standing…

PHILADELPHIA — On the heels of the federal government bringing seditious conspiracy charges against members…

Enrollment in the Trillium Lakelands District School Board (TLDSB) is expected to decline for the…

Enrollment in the Trillium Lakelands District School Board (TLDSB) is expected to decline for the…

South Devon College is the first college in Devon to have three of its healthcare…

Left to right: John Carey, Sr., John Carey, Jr., Mike Allen, Mike Gutierrez. Photo contributed.…

IIt’s always a good thing when wealthy people go to their favorite charity instead of…

On Wednesday, officials from Parul University interact with journalists in Jammu. -Excelsior/Rakesh Excelsior Correspondent JAMMU,…

RHODE ISLAND — With the evolving state of the coronavirus pandemic, Rhode Island state health…

Schools have seen the biggest single-year drop in enrollment since World War II in the…

No more newsJune 13, 2022 | 9:05 p.m.Thrissur, Jun 13 (UNI) CPI(M) General Secretary Sitaram…

Views : 5,629 Posted: Tuesday, June 7, 2022. 6:35 a.m. CST. By Zoila…

MAPLE GROVE, MN — Ballots for the Aug. 9 primary in Maple Grove will include…

Country the United States of AmericaUS Virgin IslandsU.S. Minor Outlying IslandsCanadaMexico, United Mexican StatesBahamas, Commonwealth…

OKLAHOMA CITY, Okla. (KFOR) – Following the deadly mass shooting at a Tulsa medical complex…

ST. MICHAEL, MN — The ballots in St. Michael will include contested races for several…

Harry Wilson talks crime, Matt Castelli talks safety as candidates step up campaigns Two candidates,…

Falling enrollment in the first year of the COVID-19 pandemic erased a decade of steady…

COMPLIANT. Vice Mayor of Carcar City and founder of Carcar City College (CCC), Nicepuro Apura…

James Scott Farrin Hispanic League Scholar Perla Moreno-Gil “The firm supports programs like the Hispanic…

Virginia election offices will no longer be able to accept private grants under a new…

The Illinois gubernatorial race won’t be McLean County’s only statewide Republican primary to watch next…

In observance of the Memorial Day holiday, the Town of Suffolk offices will be closed…

Half of Shelby County high school graduates do not enroll in college or trade school…

Enrollment in New Jersey’s traditional public schools has fallen by about 18,000 in the two…

Content of the article Growing up in Italy and immigrating to Canada as a teenager,…

FRANKFURT, Ky. — Attorney General Daniel Cameron announced two appointments to his leadership team. Rewa…

HORRY COUNTY SC (WBTW) — Enrollment in Horry County schools this current school year is…

Review Editor’s Note: Star Tribune Opinion publishes letters readers online and in print every day.…

Patna: In what appears to be a distinct sign of social transformation, girls from even…

Soccer | 05/19/2022 10:03:00 History links Football writers select Super 11 for 2021…

BENTONVILLE — Enrollment in the school district could increase by 2,200, or 12%, to a…

Staff, dignitaries and friends gathered at the new Humboldt location for the joint offices of…

Are you a 4 year college student or a student…

PETALING JAYA: Tropicana Corp Bhd recently announced Vacant Possession (VP) for owners of Triana offices…

2022 NOTICE OF OFFICES TO BE FILLED IN STATE GENERAL ELECTION To the Residents of…

A partial IT outage will occur over a weekend in May as The United Church…

Course period: May 7, 2021 – February 25, 2022 Lead applicant deadline: June 14, 2022…

DLA Piper is taking up new premises in Madrid, moving just down the street into…

By Suzanne Perez – Kansas News Service WICHITA, Kansas— Kansas public schools are feeling the…

WICHITA, Kansas— Kansas public schools are feeling the pinch of enrollment losses that have accompanied…

Valley News By David Ross | on May 05, 2022 By DAVID ROS…

FLORENCE, SC (WBTW) — South Carolina’s public charter schools continue to build on the momentum…

BOSTON, May 2, 2022 /PRNewswire/ — Digital Ready and Outlier.org today announced a partnership offering…

Duncan Financial of Carlsbad, California & Goldstein Financial Group of Indianapolis, Indiana selected partner in…

(The Center Square) — Ivy Tech Community College will host a pair of programs offering…

On April 22, Governor Roy Cooper earmarked $34 million in new federal funding to further…

For many, if not most, San Francisco families, the process of enrolling in the city’s…

NAIROBI, Kenya, April 23 – The Teacher Services Commission says 60,000 teachers will undergo competency-based…

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FTUIAORFOJNQZNC3N6ZHUYKWJQ.jpg)

A general view of the Jindal Power and Steel Ltd. complex. is pictured in the…

Subscribe to La Brèveour daily newsletter that keeps readers informed of Texas’ most essential news.A…

California Department of EducationPress release California Department of EducationPress release Exit: #22-21April 20, 2022 …

The law firm of Kessler Topaz Meltzer & Check, LLP (www.ktmc.com) advises investors that the…

Virginia Commonwealth University plans to increase enrollment by 2,700 students over the next five years,…

Finding time to pursue higher education is getting easier for Amazon employees.E-commerce giant partners with…

Google has revealed that it will invest around $9.5 billion in its US offices and…

College students will be allowed to take two university courses at the same time as…

According to the State Board of Education, total Michigan public school enrollment rebounded slightly in…

California public school enrollment plunged for the second straight school year under COVID restrictions, according…

(WHNT) – Need to go to a local Social Security office, but are having trouble…

JEFFERSON CITY, MO. — If a Missouri student wants to attend a virtual school, it…

SAN-JUAN – More than a million customers in Puerto Rico were left without power on…

The Office of the Commissioner of Entrance Examinations (CEE), Kerala, has released the Kerala Vocational…

By Antonio Ray Harvey, California Black Media The California task force to study and develop…

April 1, 2022 Two pernicious problems in Silicon Valley — a lack of affordable housing…

AZUSA, Calif. (KABC) — Declining enrollment at an Azusa high school is causing a domino…

SAN DIEGO COUNTY, Calif. — While all City of San Diego administrative offices will be…

School districts in Wisconsin may see lower funding due to declining summer school enrollment early…

Patterns of cyclical school enrollment growth that began in Cobb County in the 1950s are…

JOHNSON CITY, Tenn. (WJHL) — Enrollment at East Tennessee State University’s Gatton College of Pharmacy…

Hello again, Duluth! Important Update: All of you, as readers, have made the Duluth Daily…

‘It’s never too late’: University courses for adults offer ‘vital’ opportunity to develop key job…

With the platform offered by Outlier.org, a person could start taking a few college courses…

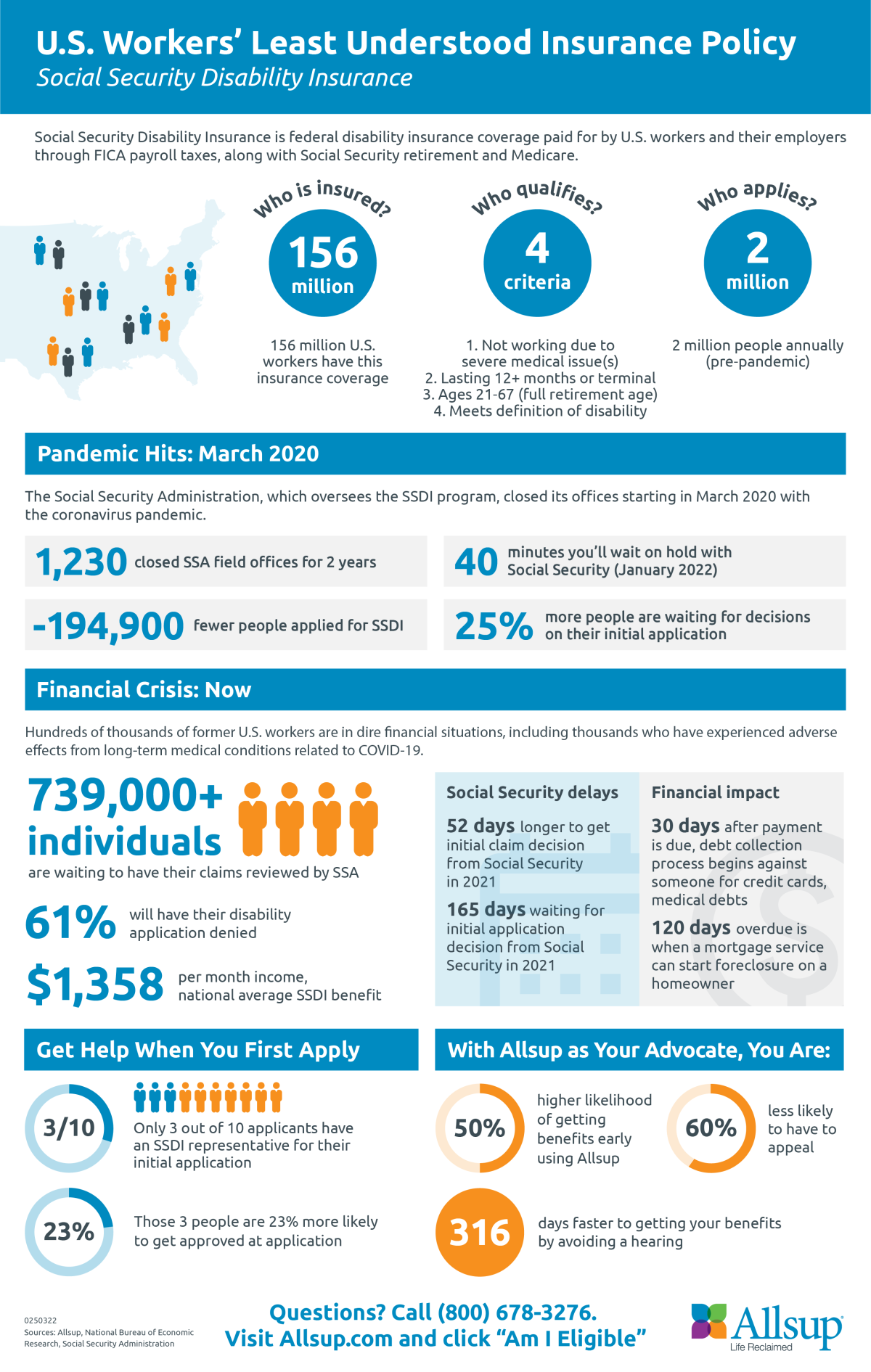

Allsup Applauds Reopening and Highlights Representatives’ Vital Role in Getting Your Social Security Disability Insurance…

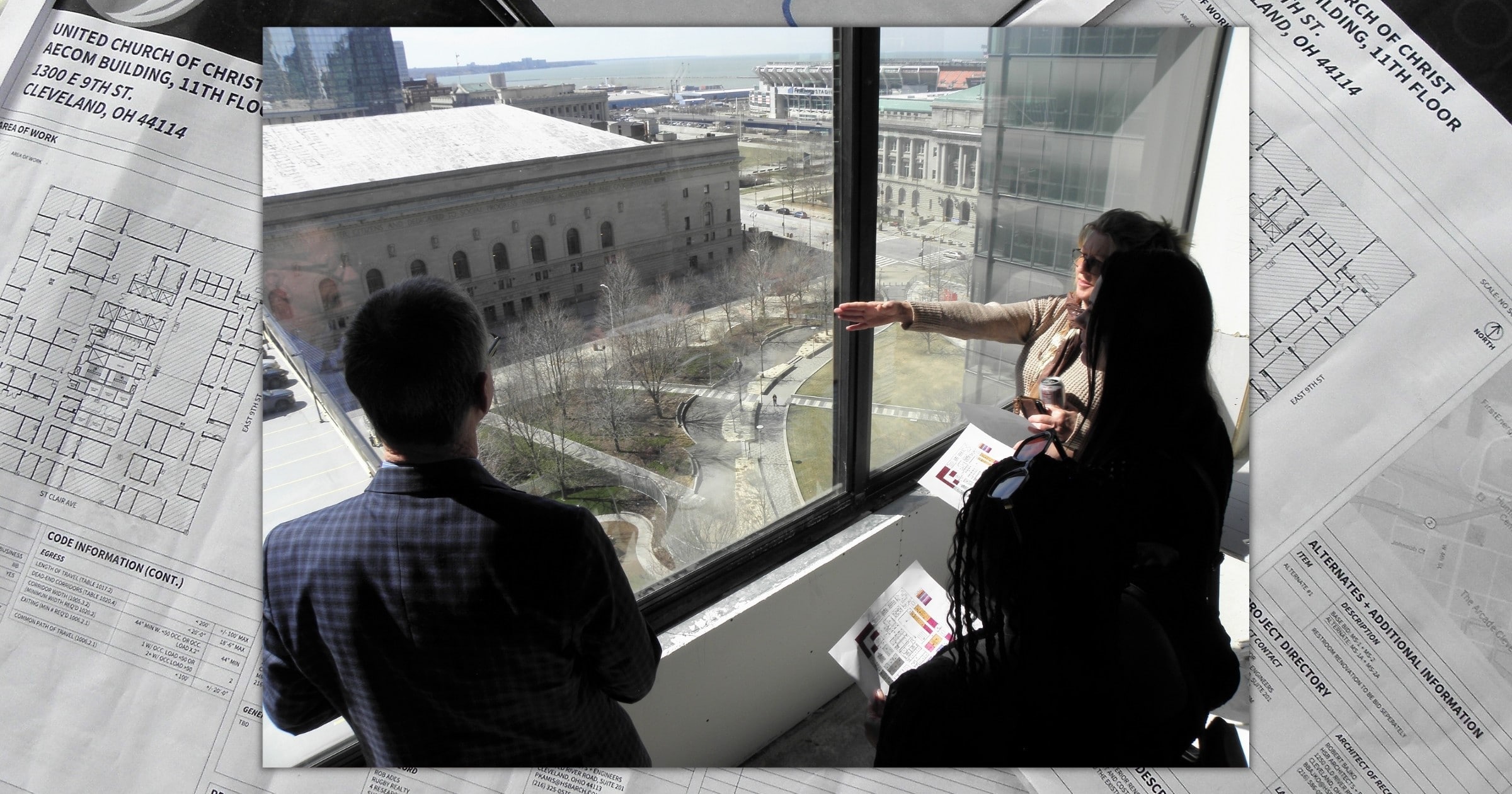

National Ministries employees of the United Church of Christ got their first glimpse of their…

Decision for the benefit of persons with disabilities; the move follows the instructions of the…

INDIANAPOLIS — The Indiana Department of Education is bringing back a program that offers free…

/cloudfront-us-east-1.images.arcpublishing.com/pmn/KMTFOSZJG5A2BMWV6RJSS7ZEPU.jpg)

Scents permeate the hallways: peanut butter cupcakes and cinnamon rolls from a culinary arts class,…

Awarding of more student spaces at NOSM University (formerly the Northern Ontario School of Medicine)…

If you’ve noticed what appears to be excessive activity in the hallways of Craven Hall,…

Depending on whether you are a senior student or a graduate taking a gap year,…

Oxford International Group, Vektr Capital Investment and Farmforte Agro-Allied Solutions Limited have reacted to their…

By Maureen O’Hare, CNN “We really had no intention of selling them,” Kevin Regan said…

(BEAVER FALLS, Pa.) – Geneva College is announcing an expanded lineup of 21 fully online…

WASHINGTON — Even before the Russian military began its invasion of Ukraine, comparisons between contemporary…

%20(3).png)

In these difficult days for Europe, we – the members of a community of research…

Dr. Piper Klemm, editor of The checkered horsereturned to The Equestrian College Advisor Live on…

By Melena DiNenna, CAPITAL NEWS SERVICEAs a grassroots, volunteer-based organization that connects homeschoolers across the…

As a grassroots, volunteer-based organization that connects homeschoolers across the state, the Maryland Homeschool Association…

Presented by: As everyone knows, a very expensive college degree that will take decades of…

OMAHA, Neb. (AP) – If you build a shiny new office building, will your employees…

Residents of the Wright City and Warrenton areas will have a few opportunities to meet…

The International Financial Reporting Standards Foundation is moving closer to establishing an International Sustainability Standards…

/cloudfront-us-east-1.images.arcpublishing.com/gray/6Z2N4OQNGFAIZKOWYS354QJXKM.jpg)

LOUISVILLE, Ky. (WAVE) – Drivers in Oldham County will no longer be able to issue…

TORRANCE, Calif. — A school in Torrance has lost nearly half of its students since…

PeopleImages/iStock.com Cleaner office environments and social distancing measures aren’t the only changes happening when people…

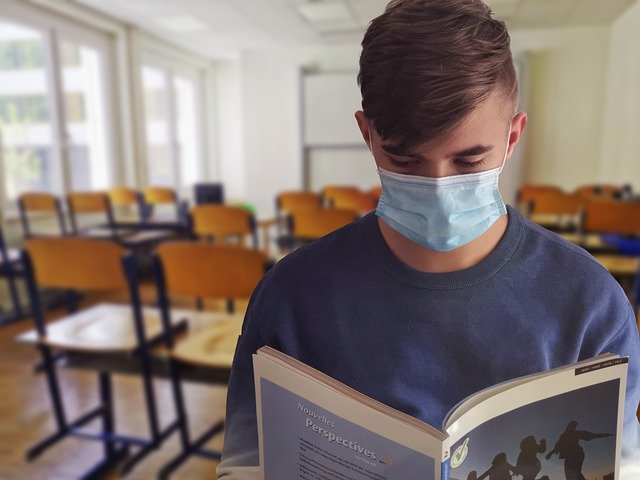

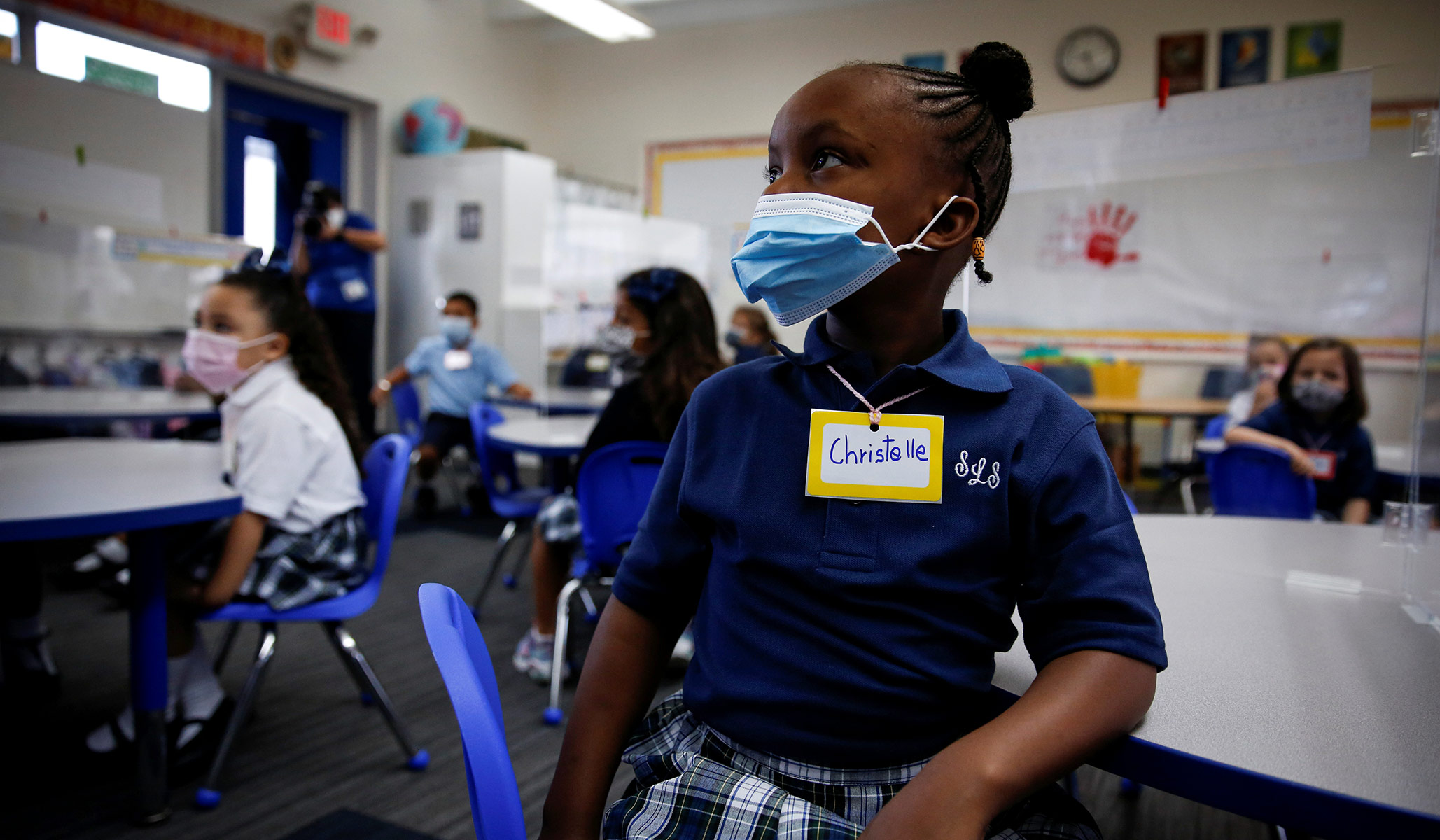

A student wearing a protective mask attends class on the first day of school amid…

Trade around 20 minutes of time for $4,000 to $10,000.It’s too good a prospect to…

Posted: 02/19/2022 13:20:17 Modified: 02/19/2022 13:19:56 GREENFIELD — Director of Enrollment Michelle Morrissey announced Thursday…

Deadline: 1-mar-22 Pro Helvetia offers residency programs in Switzerland and in the regions of the…

WASHINGTON- Enrollment in Catholic schools increased for the first time in two decades this school…